Overall of Self-billing E-invoice

- When a sale or transaction is concluded, the Supplier issues an e-Invoice to recognize their income and as a record of the Buyer’s spending (proof of expense).

- However, there are certain circumstances where another party, other than the Supplier, is allowed to issue a self-billed e-Invoice on behalf of the Supplier. This is known as a self-billing e-Invoice.

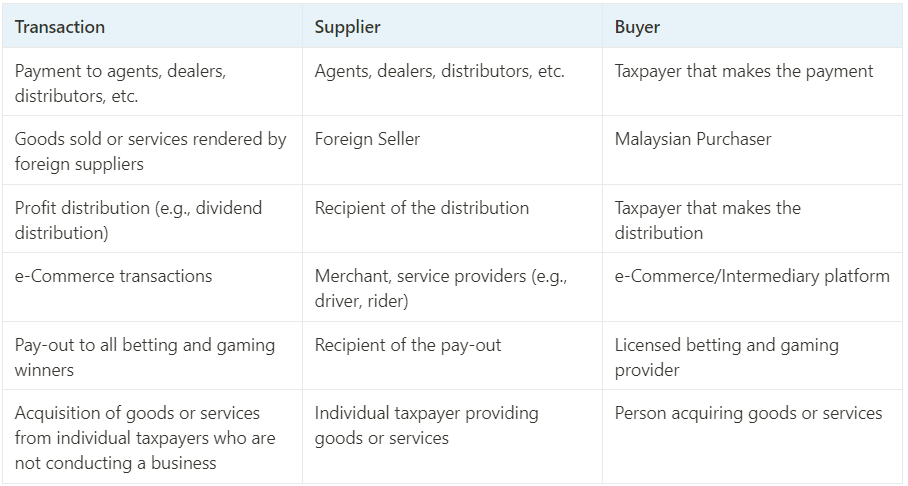

For e-Invoice purposes, self-billed e-Invoice is allowed for the following transactions:

- Payment to agents, dealers, distributors, etc.

- Goods sold or services rendered by foreign suppliers

- Profit distribution (e.g., dividend distribution)

- e-Commerce transactions

- Pay-out to all betting and gaming winners

- Acquisition of goods or services from individual taxpayers

- Where a Buyer is required to issue a self-billed e-Invoice, the Buyer assumes the role of the Supplier to be the issuer of the e-Invoice and submits it to the Inland Revenue Board of Malaysia (IRBM) for validation. Upon validation, the Buyer can use the validated e-Invoice as proof of expense for tax purposes .

Parties involved in self-billed e-Invoice:

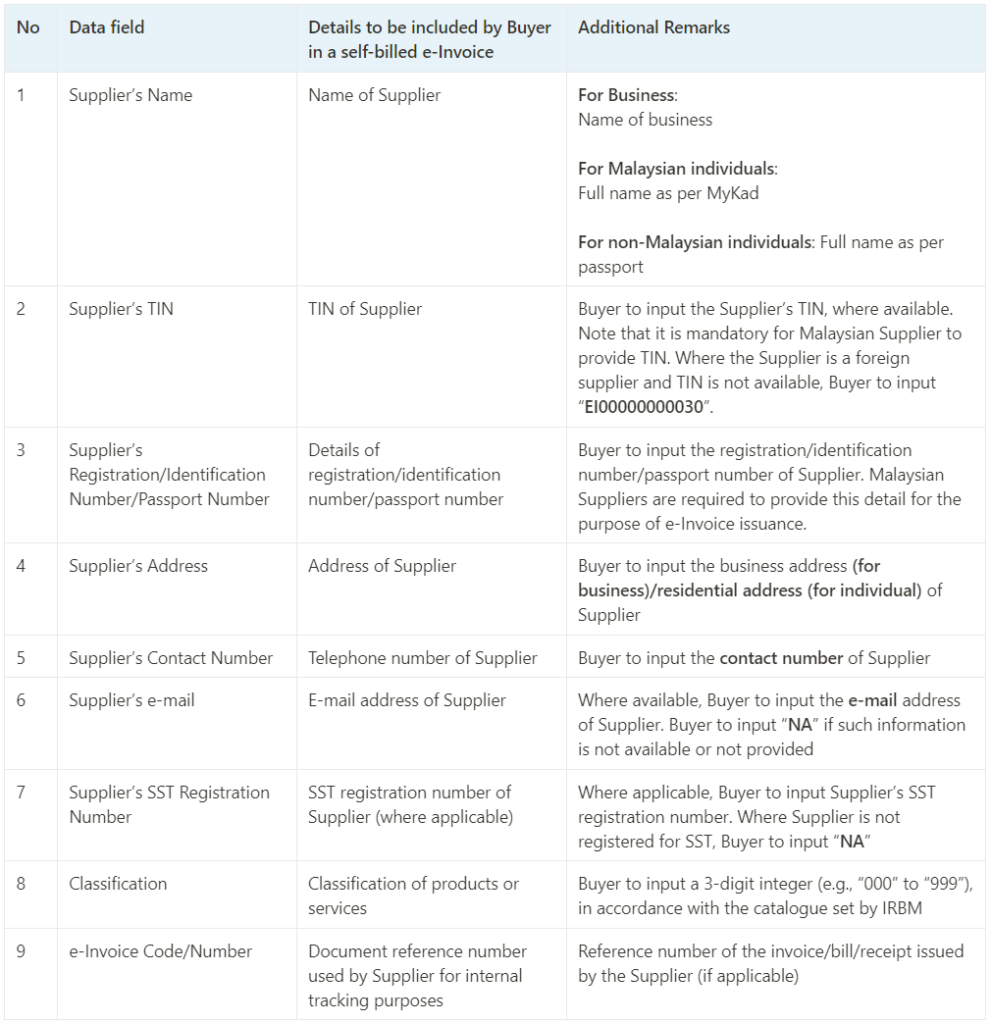

Details required to be input by Buyer for issuance of self-billed e-Invoice:

Conclusion

In conclusion, self-billing e-invoices offer numerous benefits for both businesses and individuals. They provide a streamlined and efficient way to recognize income, record expenses, and comply with tax regulations.

By understanding the eligibility criteria and advantages of self-billing e-invoices, you can optimize your financial processes and simplify record-keeping. Don’t miss out on this opportunity to enhance your financial efficiency and ensure tax compliance. Take advantage of self-billing e-invoices today!

Disclaimer: The information provided on this platform is for general informational purposes only. It does not constitute professional advice and should not be relied upon for making decisions. Wanconnect Consulting Group is not responsible for any errors or omissions in the content or for any actions taken based on the information provided. We recommend seeking professional advice for specific situations. Wanconnect Consulting Group reserves the right to modify, update, or remove any content without notice.

Payment to individual requires self billed e-invoice. What about payment to individual by staff and submit by claim afterwards? For example, for company event, we buy some kuih muih from Makcik who is an individual not conducting business and the company issue self-billed e-invoice during payment made. What if the same buy from a staff, does the company going to issue self billed e-invoice to Makcik? Which means the staff has to request all the information from Makcik for Finance to issue self-billed e-invoice? Otherwise the treatment for payment to individual won’t be the same for payment directly to Makcik and via staff claim. Kindly advise. Thank you.

For more info, please visit our FB page.