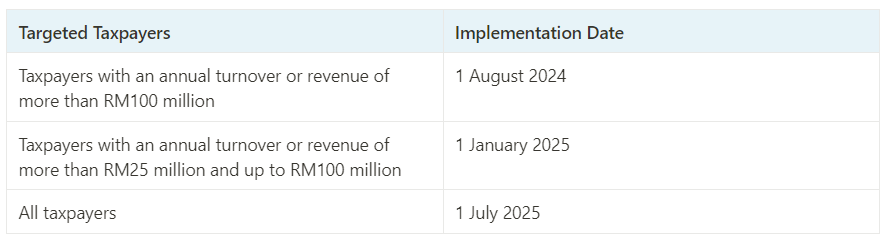

E-Invoice will be implemented in multiple phases to ensure a seamless and efficient transition. The implementation plan for e-Invoice has been meticulously crafted, taking into account various factors such as turnover or revenue thresholds. This approach aims to provide taxpayers with ample time and resources to adequately prepare for and adapt to the e-Invoice system.

Here is the comprehensive timeline for the implementation of e-Invoice:

Disclaimer: The information provided on this platform is for general informational purposes only. It does not constitute professional advice and should not be relied upon for making decisions. Wanconnect Consulting Group is not responsible for any errors or omissions in the content or for any actions taken based on the information provided. We recommend seeking professional advice for specific situations. Wanconnect Consulting Group reserves the right to modify, update, or remove any content without notice.