- Profit distribution is a crucial part of an organization’s financial operations. It involves allocating earnings to stakeholders such as shareholders, partners, and employees.

- Traditionally, companies issue dividend vouchers or warrants to distribute profits to shareholders. Other entities, like trusts and unit trusts, follow similar practices.

- However, with the implementation of e-Invoice in Malaysia, certain companies and taxpayers are now exempt from issuing self-billed e-Invoices for dividend distribution. This exemption will be periodically reviewed.

- Taxpayers who qualify for the exemption can continue their existing profit distribution processes, like issuing dividend vouchers or warrants. However, taxpayers who do not qualify must now issue self-billed e-Invoices as proof of income for the supplier.

- For self-billed e-Invoice issuance, the roles are as follows:

- Supplier: Recipient of the distribution

- Buyer: Taxpayer making the distribution

Where a self-billed e-Invoice is required to be issued, the steps involved for issuance are as follows:

Step 1:

When profit (e.g., dividend) is being paid or credited, the taxpayer that makes the distribution will issue a dividend voucher to the recipient.

Step 2:

The taxpayer that makes the distribution is required to assume the role of Supplier and issue a self-billed e-Invoice to the recipient of the distribution.

Step 3:

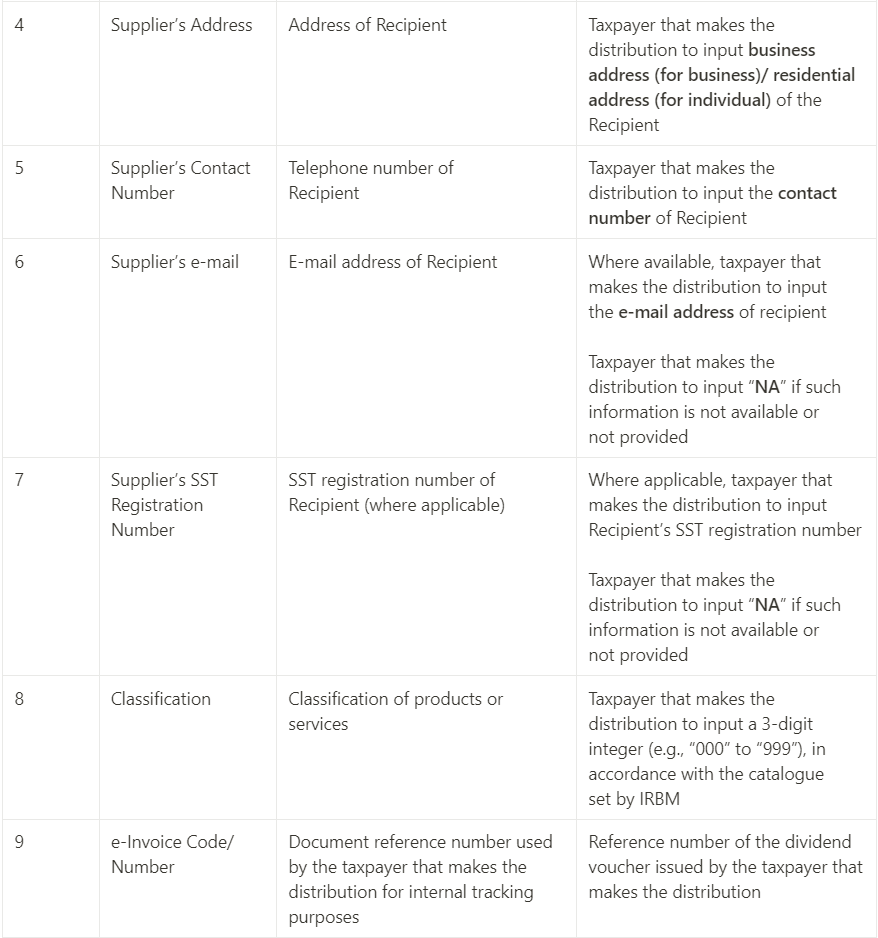

In issuing the self-billed e-Invoice, the taxpayer that makes the distribution will complete the required fields of the e-Invoice Guideline. The process of issuing a self-billed e-Invoice by the taxpayer that makes the distribution shall follow the detailed e-Invoice workflow of the e-Invoice Guideline.

The taxpayer (Buyer) needs to provide certain details in order to issue a self-billed e-Invoice to the recipient (Supplier).

Foreign Profits/ Dividend

For any foreign profits/dividends received in Malaysia, the recipient is required to issue an e-Invoice as proof of income for tax purposes.

The roles of both parties for e-Invoice issuance are as follows: (a) Supplier: Profit/Dividend Recipient (b) Buyer: Foreign Distributor

Conclusion:

In conclusion, understanding the process and requirements of profit distribution is essential for organizations. Allocating earnings to stakeholders, such as shareholders, partners, and employees, involves issuing dividend vouchers or warrants.

The implementation of e-Invoice in Malaysia has impacted this process, with certain companies and taxpayers being exempt from issuing self-billed e-Invoices for dividend distribution. The roles of suppliers and buyers in self-billed e-Invoice issuance are crucial, and specific details need to be included in the e-Invoice.

Disclaimer: The information provided on this platform is for general informational purposes only. It does not constitute professional advice and should not be relied upon for making decisions. Wanconnect Consulting Group is not responsible for any errors or omissions in the content or for any actions taken based on the information provided. We recommend seeking professional advice for specific situations. Wanconnect Consulting Group reserves the right to modify, update, or remove any content without notice.