e-Invoice Services

Other Services

Overview E-invoice model via MyInvois Portal

The MyInvois Portal is a platform that offers all the necessary functionalities for taxpayers (Suppliers) to carry out e-Invoice actions, such as generating, submitting, viewing, cancelling, or rejecting invoices. It is specifically designed to serve the following purposes:

- Allowing taxpayers to view and search for their respective e-Invoices.

- Providing a platform for taxpayers who are unable to issue e-Invoices on their own systems.

To fulfill their e-Invoice obligations in compliance with the rules and requirements set by IRBM, taxpayers are required to log in to MyTax Portal and utilize the MyInvois Portal.

E-Invoice workflow via MyInvois Portal

Pre-Submission – e-Invoice Submission Requirements

1. Provision and Digital Certificate

A Digital Certificate (e.g., .cer or .pfx) is a taxpayer identifier for online transactions. It guarantees the reliability and trustworthiness of signed content. IRBM issues the Digital Certificate based on the taxpayer’s TIN and additional information. It ensures non-repudiation, integrity, and authenticity of the e-Invoice for three (3) years.

2.How to Retrieve and Verify TIN

To make it easier for taxpayers to retrieve and verify their TIN, there are two primary avenues available:

- Utilize the MyTax Portal: Businesses can conveniently check their TIN using this platform.

- If the TIN cannot be retrieved through the MyTax Portal, taxpayers can use the e-Daftar platform to initiate registration and obtain their TIN by following these steps:

a. Log in to MyTax Portal.

b. Choose the e-Daftar option.

c. Fill in the required fields, such as the type of taxpayer, email, and phone number/mobile number.

d. Click “Search” to register the taxpayer’s TIN.

These are the Step for accessing MyInvois Portal:

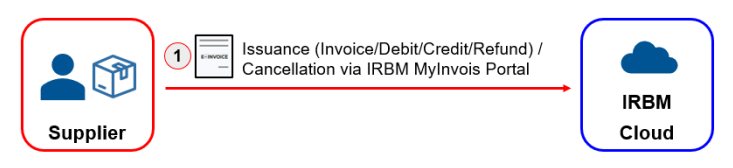

Step 1 – Creation and Submission

When a sale or transaction is concluded, including e-Invoice adjustments such as debit notes, credit notes, and refund notes, the Supplier creates an e-Invoice and submits it to IRBM via the MyInvois Portal for immediate validation.

Two options are available for creating and submitting e-Invoices:

- Individual Creation: Taxpayers can create e-Invoices individually by completing a form with all the required fields. Taxpayers can log in to the MyInvois Portal to access this option.

- Batch Generation: Taxpayers can generate a certain number of e-Invoices in batches by uploading a defined layout file to the portal, which includes the necessary invoice information.

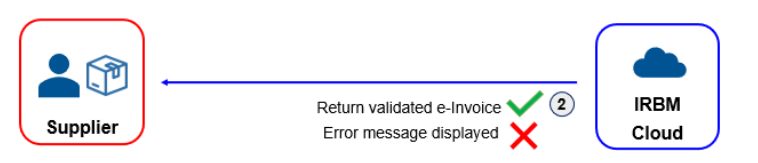

Step 2 – E-Invoice Validation

Once the e-Invoice is validated (which is done in near real-time), the Supplier will receive a validated e-Invoice in PDF format from IRBM via the MyInvois Portal.

The validated e-Invoice will include the IRBM Unique Identifier Number, date and time of validation, and a validation link. The IRBM Unique Identifier Number ensures traceability by IRBM and reduces the risk of tampering with the e-Invoice.

If the e-Invoice is returned unvalidated, an error message will be displayed. In such cases, the Supplier is required to correct the errors and submit the e-Invoice for validation again once the necessary corrections have been made.

Step 3 – Notification

Once the e-Invoice has been validated, both the Supplier and Buyer will receive notifications through the MyInvois Portal. An email will be sent to notify them about invoice clearance and any buyer rejection requests.

This step involves the following actions:

- Supplier and Buyer notification through the MyInvois Portal.

- Email notification regarding invoice clearance and buyer rejection requests.

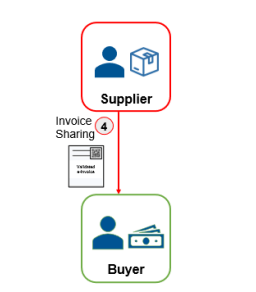

Step 4 – Sharing of e-Invoice

After validation, the Supplier is responsible for sharing the validated e-Invoice with the Buyer. The e-Invoice will be embedded with a QR code provided by IRBM. The QR code can be utilized to verify the existence and status of the e-Invoice through the MyInvois Portal.

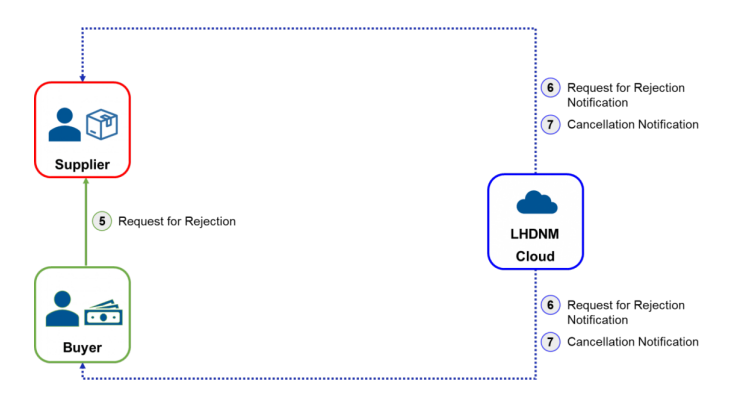

Step 5,6 and 7 – Rejection or Cancellation

After validation, the e-Invoice can be rejected or canceled within 72 hours.

- Buyer’s Rejection Request:

- If the e-Invoice has errors, the Buyer can request rejection via the MyInvois Portal.

- The reason for rejection should be specified.

- Supplier can cancel the e-Invoice if they agree.

- If the rejection request is not accepted, no cancellation is allowed after 72 hours. A new e-Invoice is required for amendments.

- Supplier’s Cancellation:

- Supplier can cancel the e-Invoice within 72 hours if errors are present.

- Justifications must be provided.

If the e-Invoice is not rejected or canceled within 72 hours, a new e-Invoice (credit note, debit note, or refund note e-Invoice) is needed for subsequent adjustments.

- Further explanation for Step 1 to 7

Stationery Hub Sdn. Bhd. (Supplier) is an MSME that supplies stationery items. They generate an e-Invoice for the sale of 50 stationery items to Mrs. Kim (Buyer) on the MyInvois Portal. After validation by IRBM, both parties are notified. Mrs. Kim checks the e-Invoice for accuracy and completeness. If there are errors, she can request rejection within 72 hours through the portal.

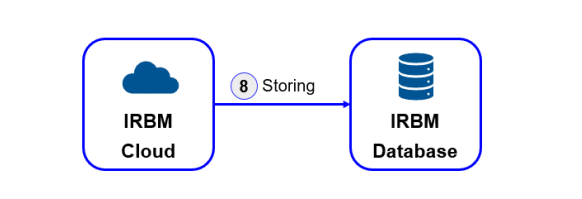

Step 8 – Storing e-Invoices

All accepted and validated e-Invoices submitted via the MyInvois Portal will be stored in IRBM’s database.

However, taxpayers are reminded to retain adequate records and documentation related to the transaction, in addition to the e-Invoice stored by IRBM.

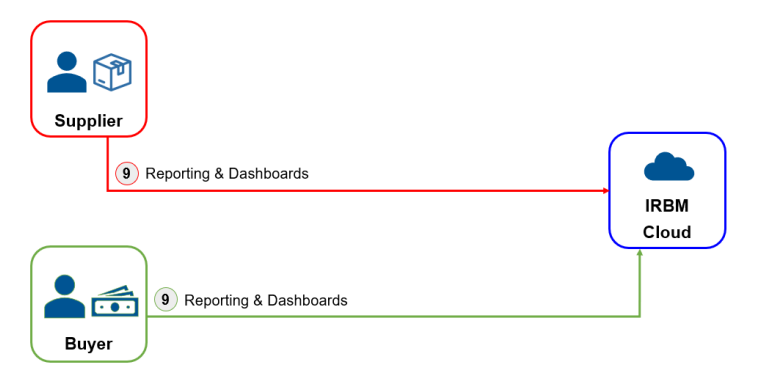

Step 9 – Reporting and Dashboard Services for Taxpayers

Through the MyInvois Portal, both Suppliers and Buyers have the option to request and retrieve e-Invoices. The MyInvois Portal provides essential invoice details, such as the invoice date, amount, invoice status, and other relevant information submitted to IRBM.

These details can be obtained in various formats including:

- XML/JSON (either one-by-one or in a package)

- Metadata

- CSV report

- Grid

- PDF file

Conclusion

Introducing the MyInvois Portal, a revolutionary platform for e-invoicing that streamlines the invoicing process and eliminates manual paperwork. With features like easy access to view and search e-invoices, secure digital certificates, and effortless generation, submission, and management of invoices, the MyInvois Portal is a game-changer for businesses.

Our services include:

- Research and select an e-invoicing solution that aligns with your business needs and compliance requirements.

- Determine how the e-invoicing solution will integrate with your existing accounting, ERP, and other relevant systems.

- Provide training and education to your employees on how to use the e-invoicing system effectively.

- Conduct thorough testing and validation of the e-invoicing solution to ensure it meets your business requirements and regulatory compliance standards.

- Establish processes for generating compliance reports and submitting required documentation to regulatory authorities

- Embrace a culture of continuous improvement to adapt to changing regulatory requirements, technological advancements, and evolving business needs.