e-Invoice Services

Other Services

Tax Compliance for Corporate

1. Sdn Bhd vs LLP

Sdn Bhd vs LLP: Choosing the Right Business Structure in Malaysia

When starting a business in Malaysia, one of the most crucial decisions you’ll need to make is choosing the appropriate business structure. Two common options are Sdn Bhd (Sendirian Berhad) and LLP (Limited Liability Partnership). Therefore, understanding the differences between these two structures can help you make an informed decision for your business.

Sdn Bhd (Sendirian Berhad)

Sdn Bhd is a private limited company, which is the most common business structure in Malaysia. Here are some key features of Sdn Bhd:

- Limited Liability: One of the main advantages of Sdn Bhd is limited liability protection. As a shareholder, your personal assets are separate from the company’s liabilities. This provides financial security and protects your personal wealth.

- Separate Legal Entity: Sdn Bhd is a separate legal entity from its owners. It can enter into contracts, own assets, and sue or be sued in its own name. This provides credibility and allows for easier business transactions.

- Perpetual Existence: Sdn Bhd has perpetual existence, meaning it continues to exist even if the shareholders or directors change. This provides stability and continuity for long-term business operations.

LLP (Limited Liability Partnership)

LLP is another popular business structure in Malaysia. Here’s what you need to know about LLP:

- Shared Liability: LLP offers limited liability protection to its partners. Each partner is only liable for their own actions or misconduct, providing personal asset protection.

- Flexibility: LLP provides flexibility in terms of management and decision-making. Partners can participate in the day-to-day operations and have equal say in important matters. This fosters a collaborative working environment.

- Taxation: LLP is a tax-transparent entity, which means it is not subject to corporate tax. Instead, the partners report their share of profits and losses in their individual tax returns. This can result in potential tax savings.

Choosing the Right Structure for Your Business

When deciding between Sdn Bhd and LLP, you can consider the following factors:

- Liability Protection: If protecting personal assets is a top priority, Sdn Bhd may be the better choice as partners can enjoy the benefit of limited liability, meaning their personal assets are protected in case of business debts or legal issues However, if partners want individual liability protection, LLP is a suitable option where each partner is protected from the actions of the other partners.

- Tax Considerations: When considering your business’s tax obligations, it’s important to think about the type of entity you choose. Sdn Bhd is subject to corporate tax, meaning the company’s profits are taxed at the corporate tax rate. However, an LLP offers potential tax savings for partners as the profits are taxed at each partner’s personal income tax rate. This can result in lower tax liabilities for LLP partners.

- Future Plans: Consider your long-term business goals. If you plan to expand and raise capital through external investors, Sdn Bhd may be more suitable. For professional services firms or small-scale partnerships, LLP can be a flexible and efficient option. This is because LLPs provide the benefits of limited liability while allowing partners to have more control and flexibility in managing the business.

2. Registering of TIN no. (C no/ PT no.) & where to apply

Registering for TIN no. (C no/ PT no.) in Malaysia

When starting a business in Malaysia, one important step is obtaining a Tax Identification Number (TIN), also known as the C number or PT number. The TIN is a unique ID assigned to businesses for tax purposes.

Taxpayers can register for a (TIN) via online or through paper channels. The registration form can be printed from the IRBM’s webpage or completed at IRBM branches in Malaysia. However, online registration through the “e-Daftar” system is encouraged.

To register for a TIN in Malaysia, you can follow these steps:

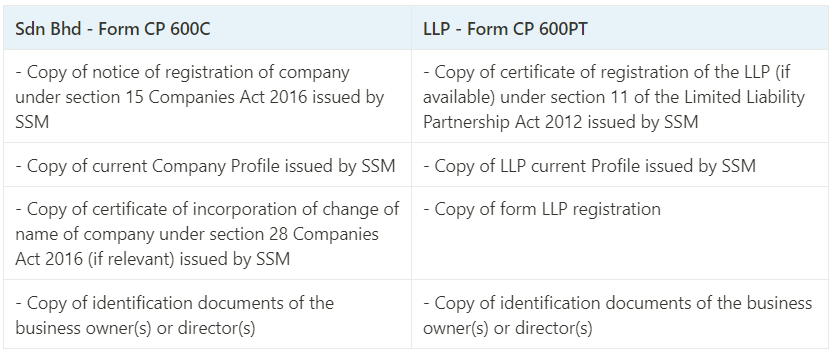

- Prepare the necessary documents: You will need to provide the following documents for TIN registration:

- Visit the nearest Inland Revenue Board (LHDN) branch: Go to the nearest LHDN branch office and bring all the required documents.

- Fill out the necessary forms: Complete the forms provided at the LHDN office with your business information.

- Submit the application: Hand in the completed forms and required documents to the LHDN officer. They will process your application and give you a TIN.

3. Compliance for Companies (CP204, Form EA, E, Form C/PT)

Compliance for Companies (CP204, Form EA, E, Form C/PT)

Compliance for companies in Malaysia involves various requirements and forms that need to be submitted. Here are some key compliance documents:

Compliance for companies in Malaysia involves several key forms:

- CP204: Pursuant to subsection 107C (7A) of the ITA, this form to declare their estimated chargeable income and installment payment. It must be submitted to the Inland Revenue Board (LHDN), accurately reflecting the company’s income and tax liability.

- Form EA: It is a vital document for employers in Malaysia as it is legally required under Section 83(1A) of the Income Tax Act 1967. It provides detailed information on employee remuneration, deductions, and tax calculations, ensuring transparency and accountability in the employer-employee relationship. Complying with this regulation and accurately completing Form EA is essential for smooth tax filing and fulfilling legal obligations.

- Form E: It is a report submitted by employers to inform the IRB about the number of employees and their income details. The report must be submitted by 31st March each year, as required by Section 83(1) of the Income Tax Act 1967. The report should include:

- Total number of employees within the company;

- Number of new hires and employees who have left

- Employer’s and each employee’s details

- Income details for each employee

- Form C/PT: This form is used to report the company’s annual income and tax calculations. It is submitted by companies to LHDN and provides details of the company’s income, deductions, and tax liability. Companies must accurately complete this form, as it serves as a comprehensive record of their financial activities throughout the year. By providing detailed information on their income, deductions, and tax liability, companies can demonstrate their compliance with tax regulations and facilitate a smooth tax assessment process.

In summary, these forms play a crucial role in ensuring accurate reporting of income, deductions, and tax calculations for both companies and employees.

4. Tax estimate and revision (CP204/CP204A)

CP204

Pursuant to subsection 107C (7A) of the ITA, CP204 is a form used by companies to declare their estimated chargeable income and installment payment. It provides information on the company’s estimated income and tax liability and is submitted to the Inland Revenue Board (LHDN). Companies must accurately estimate their chargeable income and calculate their tax liability based on the prevailing tax rates. According to subsection 107C (3) of the ITA, the minimum tax estimate for a year of assessment should be at least 85% of the amendment of tax estimate or the tax estimate amount for the immediate preceding year of assessment.

CP204A

In addition to the CP204 form, businesses may also need to submit the CP204A form. The CP204A form is used as an adjustment form for CP204. It is utilized when businesses need to make amendments to their estimated tax payable. For instance, if a business realizes that it has overestimated or underestimated its tax payable for the year, it can submit the CP204A form to adjust its tax installment payments accordingly.

5. Tax rate for SME vs non-SME

Definition of SMEs

SME companies, also known as Small and Medium Enterprises, are businesses that meet certain criteria. These criteria include:

- Having a paid-up share capital that does not exceed RM2.5 million

- Having a gross income from the business source that does not exceed RM50 million

In addition to these conditions, starting from YA 2024, there is an additional requirement for SMEs to qualify for the preferential tax rate. This requirement states that if more than 20% of the paid-up share capital is owned by a foreign company or a non-Malaysian citizen, the SME will not be eligible for the preferential tax rates of 15% and 17%. This means that the SME will have to pay taxes at a different rate.

Tax Rates

6. Deadline for submission (CP204,CP204A, Form E, EA, Form C/PT)

CP204,CP204A

Under subsection 107C (2) of the ITA 1967, companies, cooperatives, trust bodies and LLPs in operation must submit e-CP204 not later than 30 days before the commencement of the basis period for a year of assessment.

While Form CP204A for a year of assessment can be amended in the 6th, 9th or 11th month (Budget 2023 introduced) in the basis period for a year of assessment.

Form E

Form E must be submitted to LHDN by 31st March following the end of financial year. While the e-filing deadline for this form is usually one month later, on 30th April.

Form EA

The employer must issue Form EA to employees by 28th February of the assessment year.

Form C/PT

Depending on the dates of your company’s financial year, you will need to submit Form C, the income tax return form for companies, and Form PT, the income tax return form for LLPs, to the LHDN 7 months after the end of the financial year. The e-filing deadline is estimated to be one month later, 8 months after the end of the financial year.

7. Penalty for non-compliance

CP204

The Inland Revenue Board of Malaysia (LHDN) has the authority to impose penalties for late or incorrect submission of CP204 forms. The specific penalties may include:

- Late Submission Penalty: If a company fails to pay the monthly installment of the tax estimate by the specified date, a late payment penalty of 10% will be applied to the unpaid balance of the tax installment for that month.

- Incorrect Information Penalty: If the difference between the actual tax payable and the revised estimate (or the original estimate of tax payable, if no revised estimate is furnished) exceeds 30% of the actual tax payable, a 10% increase will be imposed on that difference.

- Late Payment Penalty: If the balance of tax payable is not paid by the due date, a 10% penalty will be imposed on the outstanding amount.

Form E

Failure to prepare and file Form E within the allotted due date can result in a fine of up to RM20,000 (minimum fine – RM200). Additionally, individuals may face imprisonment for up to 6 months under Section 120(1)(b) of the Income Tax Act.

Form EA

Non-submission of Form EA by the specified due date can result in a penalty of RM200 to RM20,000, or up to six months of imprisonment, or both.

Form C/PT

The penalties for non-compliance with income tax regulations in Malaysia can vary depending on the type of offense committed. According to the Inland Revenue Board of Malaysia, here are some common offenses and their corresponding penalties:

- Failing to furnish an income tax return: RM200 to RM20,000 or a term not exceeding 6 months’ imprisonment, as stated under Section 112(1) of the Income Tax Act 1967.

- Making an incorrect tax return by omitting or understating any income: RM1,000 to RM10,000 and 200% of the tax undercharged, as stated under Section 113(1)(a) of the Income Tax Act 1967.

- Willfully evading tax or helping someone else do so: RM1,000 to RM20,000 and/or imprisonment for a term not exceeding 3 years, and 300% of the undercharged tax, as stated under Section 114(1) of the Income Tax Act 1967.

- Attempting to leave the country without paying tax: RM200 to RM20,000 and/or imprisonment for a term not exceeding 6 months, as stated under Section 114(1) of the Income Tax Act 1967.

- Assist or advise (without reasonable care) others to under declare their income : RM2,000.00 to 20,000.00 and/or imprisonment for a term not exceeding 3 years, as stated under Section 114(1A) of the Income Tax Act 1967.

Our services include:

- Tax Preparation Services

- Tax Compliance Assistance

- Tax Education and Workshops

- Tax Problem Resolution

- Tax Planning

- Tax Compliance Reviews