In the world of e-invoicing, two terms often come up: reimbursements and disbursements. These terms refer to out-of-pocket expenses incurred during the course of rendering services or selling goods.

Reimbursements

Reimbursements refer to expenses incurred by the payee (i.e., the supplier) in the course of rendering services or selling goods to the payer (i.e., the buyer). These expenses, which are subsequently reimbursed by the payer, can include costs such as airfare, travel, accommodation, telephone, and photocopying charges.

Disbursements

On the other hand, disbursements are expenses incurred by the payer and paid to a third party by the payee in connection with services rendered or goods sold. In other words, the payee pays these expenses on behalf of the payer.

Currently, suppliers often include both reimbursements and disbursements in their invoices to buyers.

Scenario 1 : Supplier 1 Issues E-Invoice to Buyer

To better understand how this works, let’s consider a scenario where ‘Supplier 1’ represents the first supplier, and ‘Supplier 2’ represents the third party/intermediary.

In this scenario, Supplier 1 issues an e-Invoice directly to the Buyer for the goods sold or services rendered. Subsequently, Supplier 2 makes a payment to Supplier 1 to settle the said e-Invoice issued to the Buyer, in accordance with the arrangement agreed between Supplier 2 and the Buyer.

As a result, Supplier 2 will issue an e-Invoice to the Buyer for the goods sold or service rendered by Supplier 2. Since Supplier 1 has already issued an e-Invoice to the Buyer, this should not be included in the e-Invoice issued by Supplier 2 to the Buyer.

The steps involved in this process are as follows:

- Step 1: Supplier 2 enters into an agreement with the Buyer for the supply of goods or provision of services. As part of the arrangement, Supplier 2 will make payment on behalf of the Buyer to settle any expenses incurred during the contract period.

- Step 2: Upon concluding a sale or transaction, Supplier 1 will issue an e-Invoice directly to the Buyer as per the required fields as outlined in Appendices 1 and 2 of the e-Invoice Guideline and submit it to IRBM for validation.

- Step 3: Supplier 2 will make payment on behalf of the Buyer to Supplier 1 to settle the outstanding amount. Supplier 1 will issue payment proof to Supplier 2 for the settlement.

- Step 4: Supplier 2 will issue an e-Invoice to the Buyer for the goods supplied or services rendered by Supplier 2 to the buyer. Supplier 2 should neither include the payment made on behalf of the Buyer in Supplier 2’s e-Invoice nor issue an additional e-Invoice for it. Supplier 2 provides payment proof to the Buyer to recover the payment made to Supplier 1 on behalf of the Buyer.

Practical Example 1 : Event Planning

Perniagaan Adibah hired an event planner for their product launch on 9 October 2024. The event planner sourced flowers from a florist for decoration. The florist issued an e-Invoice directly to Perniagaan Adibah for the flowers supplied.

As per their service contract, the event planner paid RM4,000 to the florist on behalf of Perniagaan Adibah for the flowers. Later, the event planner issued an e-Invoice to Perniagaan Adibah for services rendered, excluding the RM4,000 paid on behalf. To recover the RM4,000, the event planner provided a copy of the payment proof to Perniagaan Adibah.

Practical Example 2 : Intercompany Transactions

DEF Company Sdn Bhd (DEF) is a subsidiary of ABC Company Sdn Bhd (ABC). HR Hiring Sdn Bhd provided recruitment services to DEF amounting to RM10,000 and issued an e-Invoice to DEF.

Due to cash flow constraints, ABC paid RM10,000 to HR Hiring Sdn Bhd on behalf of DEF and recorded an amount owing from DEF. DEF repaid the amount to ABC on 31 December 2024. In this case, there’s no requirement for an e-Invoice to be issued by HR Hiring Sdn Bhd to ABC or by ABC to DEF, as there’s no sale or transaction between these parties. However, if ABC charges an intercompany fee to DEF for the payment made on behalf arrangement, an e-Invoice is required to be issued by ABC to DEF.

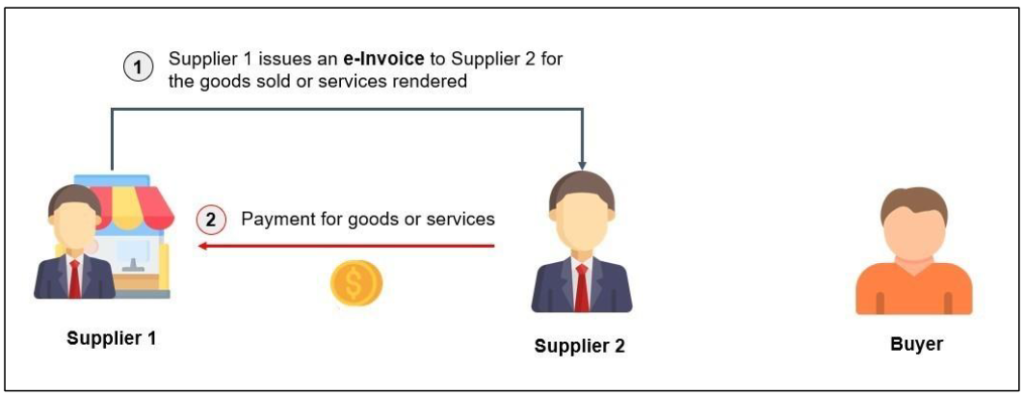

Scenario 2: Supplier 1 Issues E-Invoice to Supplier 2

In this scenario, Supplier 1 issues an e-Invoice to Supplier 2 for the goods or services intended for the Buyer. Supplier 2 makes payment to Supplier 1, according to the arrangement agreed between Supplier 2 and the Buyer.

Subsequently, Supplier 2 issues a separate e-Invoice to the Buyer to record the amount incurred on behalf of the Buyer, along with the goods or services rendered by Supplier 2. These are presented as separate line items in the e-Invoice.

The steps involved in this process are similar to the previous scenario, with the main difference being that Supplier 1 issues the e-Invoice to Supplier 2 instead of the Buyer.

Practical Example 3: Event Planning with Additional Expenses

Let’s consider a variation of Example 7. In this scenario, the event planner incurs an additional expense of RM30,000 to rent a hotel banquet hall for the product launch event. The hotel issues an e-Invoice to the event planner for this expense.

In this case, the event planner will issue an e-Invoice to Perniagaan Adibah to charge for the service provided as well as to recover the cost of the hotel banquet hall rental. These charges will be presented as separate line items in the e-Invoice issued by the event planner.

Conclusion

In conclusion, understanding the concepts of reimbursements and disbursements in e-Invoicing is crucial for businesses. These terms refer to out-of-pocket expenses incurred during the course of rendering services or selling goods.

The examples provided illustrate various scenarios where these concepts come into play, such as event planning and intercompany transactions. They highlight the importance of clear and accurate invoicing, especially when multiple expenses and charges are involved.

Remember, every transaction counts, and every invoice matters!

Disclaimer: The information provided on this platform is for general informational purposes only. It does not constitute professional advice and should not be relied upon for making decisions. Wanconnect Consulting Group is not responsible for any errors or omissions in the content or for any actions taken based on the information provided. We recommend seeking professional advice for specific situations. Wanconnect Consulting Group reserves the right to modify, update, or remove any content without notice.