CP21,CP22 and CP22A

What are CP21, CP22 and CP22A Forms in Malaysia?

What is CP 21 Form?

If an employee, who is liable to pay taxes on their employment income, is planning to leave or is about to leave Malaysia for a period of more than 3 months, the employer must provide Form CP21 at least 30 days before the employee’s expected departure date.

What is CP 22 Form?

CP22 form is a government report issued by the LHDN. It is a Notification of New Employee form. Employers are required to notify the nearest IRB branch within one month of the new employee’s commencement date.

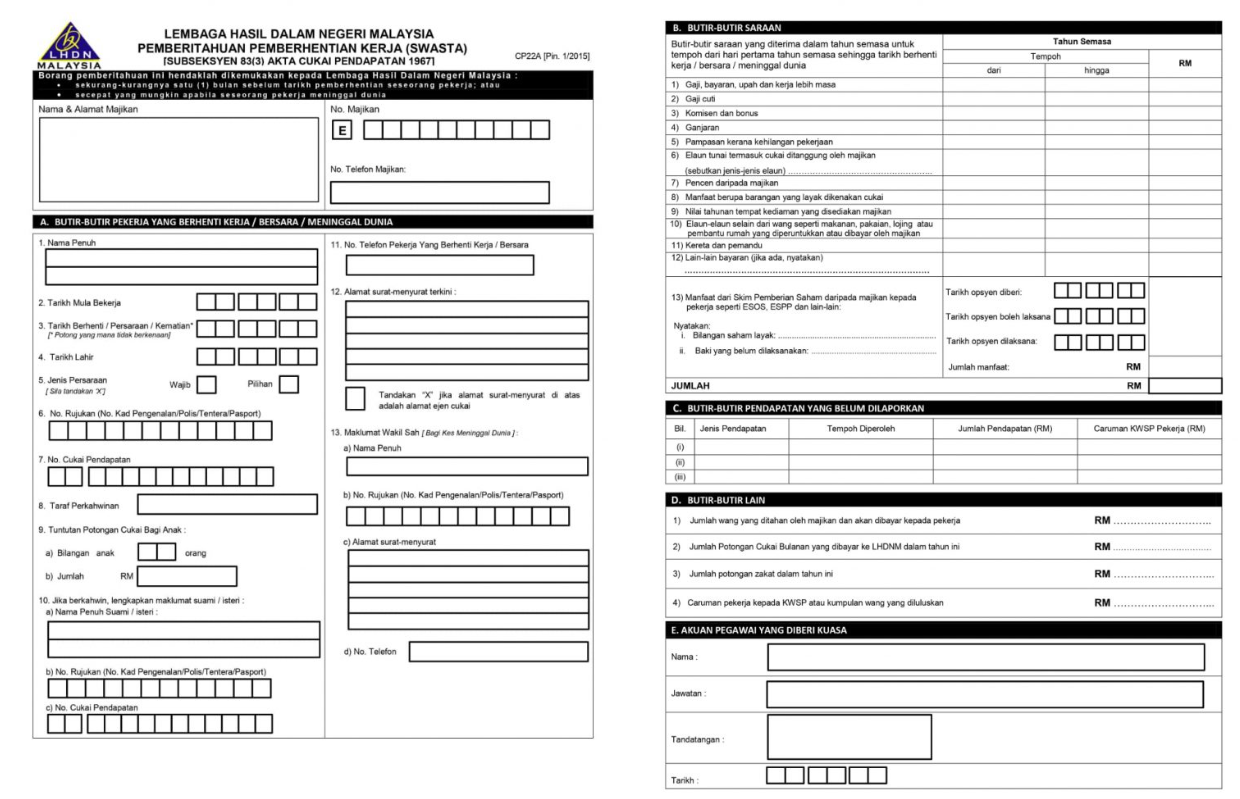

What is CP22A Form?

CP22A is a form that employers must submit to the MIRB to notify them of the cessation of employment of private sector employees. Employers must submit this form not less than 30 days before the cessation of employment or not more than 30 days after being informed of the death of an employee.

CP 21 Form are as follow:

CP22 Form are as follow:

CP22A Form are as follow:

Penalties for Non-Compliance

Failure to comply with the responsibility without any reasonable excuse, upon conviction of an offense, will result in a fine of not less than RM200 and not more than RM20,000, imprisonment for a term not exceeding 6 months, or both.

我们的服务包括:

- 准备就业手册

- 准备就业合同

- 准备公司人力资源政策和信函

- 计算薪资,如工资、加班费、佣金等

- 准备月度薪资报表