EPF

1. The Employees Provident Fund (EPF): Unlock Your Financial Freedom!

Are you ready to take control of your financial future? Look no further! The Employees Provident Fund (EPF), also known as KWSP, is here to help you achieve your financial goals and secure a brighter tomorrow.

2. What is EPF?

The Employees Provident Fund (EPF) is a social security organization that provides retirement benefits for private sector and non-pensionable employees in Malaysia. Established in 1951, it is one of the oldest and largest retirement funds in the world.

With over 14 million members, total contributions reaching RM800 billion, and total assets under management inching closer to a trillion ringgit, EPF is a trusted institution for securing your financial future.

3. How Does EPF Work?

EPF is governed by the Employees Provident Fund Act 1991, which provides for the law relating to a scheme of savings for employees’ retirement and the management of the savings for retirement purposes.

As an employee, your employer is legally required to make EPF contributions on your behalf. These contributions, along with the returns generated through prudent investment strategies, form the basis of your retirement savings.

4. Rate of Contributions

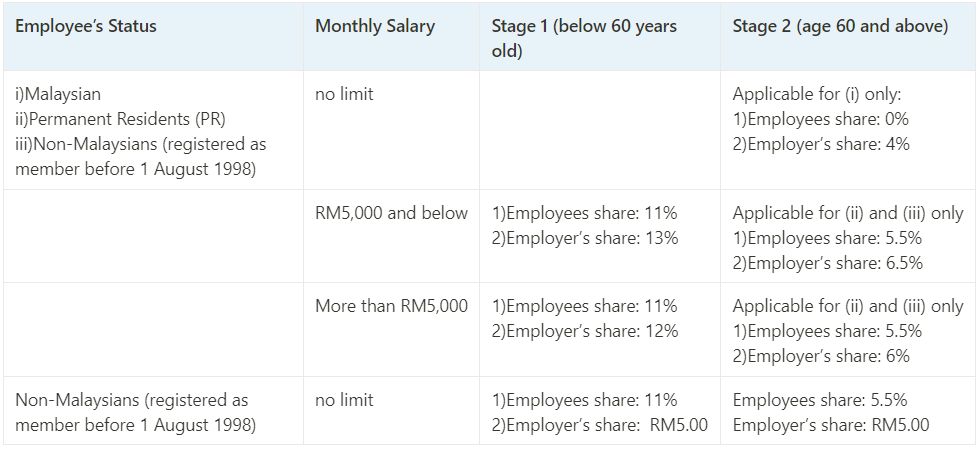

As an employer, you are required to pay EPF contributions in respect of any person you have engaged to work under a Contract of Service or Apprenticeship. You have to ensure accurate monthly contributions are deducted from your employees’ salary and remitted to EPF. The contribution rate for employees and employers effective July 2022 ‘salary/wage’ can be referred in the Third Schedule, EPF Act 1991.

The contribution rate is as follows:

- Employers are not allowed to calculate the employer’s and employee’s share based on exact percentage EXCEPT for salaries that exceed RM20,000.00. The total contribution which includes cents shall be rounded to the next ringgit.

5. EPF Contributions

What Payments Liable for EPF Contributions?

EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers. These contributions, comprising the member’s and employer’s share, will be credited into the member’s EPF account.

The following payments are liable for EPF contributions:

- Salaries

- Payments for unutilized annual or medical leave

- Bonuses

- Allowances

- Commissions

- Incentives

- Arrears of wages

- Wages for maternity leave

- Wages for study leave

- Wages for half-day leave

- Other contractual payments or otherwise

What Payments Not Liable for EPF Contributions?

The following payments are exempted from EPF contributions:

- Service charges

- Overtime payments

- Gratuity (payment to employee payable at the end of a service period or upon voluntary resignation)

- Retirement benefit

- Retrenchment, temporary lay-off or termination benefits

- Any travelling allowance or the value of any travel concession

- Any other remuneration or payment as may be exempted by the Minister

6. Deadline on Submission

The deadline for EPF submission is on the 15th of the following month. If contributions are made later than the 15th of the following month, interest will be charged for late payment of contribution. The minimum fine for late payment is RM10.

7. Resignation or Termination

If an employee resigns or is terminated, there is no need to submit any special forms to KWSP. However, you must inform KWSP if you are temporarily or permanently not employing any workers. You can notify KWSP by mail, email, or other designated channels.

In case of miscalculating an employee’s EPF contributions, you can submit another Form A to EPF after reviewing and approving the previous one.

8. The registration of EPF

Here is a step-by-step guide for the EPF registration process:

- Employer hires an employee: The employer must hire an employee before initiating the registration process.

- Registration within 7 days: Employers are required to register with the EPF within 7 days from when they first hire an employee.

- Online registration: The registration process can be done online through the EPF’s Smart Registration facility.

- Access Smart Registration: Employers need to access the EPF’s Smart Registration facility, which is available on their official website.

- Provide necessary information: Employers are required to provide the necessary information about themselves and their employees during the registration process. This includes personal and employment details.

- Make contributions online: Once the registration is complete, employers can start making contributions to the EPF online. This allows for convenient and efficient contribution management.

- e-KYC process: The Smart Registration facility includes an e-KYC (electronic Know Your Customer) process to verify the identity of the employer and employee. This ensures the accuracy and security of the registration process.

By following these step-by-step instructions, employers can easily register with the EPF and begin making contributions for their employees’ retirement benefits.

9. Benefits of EPF

EPF offers a range of benefits to its members:

- Retirement Benefits: EPF provides retirement benefits to its members. You can withdraw your savings for approved purposes, such as purchasing a house, financing your children’s education, or medical treatment.

- Savings for Housing: EPF offers savings for housing, allowing members to withdraw their savings to finance the purchase of a house or reduce their housing loan.

- Savings for Education: EPF provides savings for education, enabling members to withdraw their savings to finance their children’s education.

10. Compliance Requirements

Employers are legally required to make EPF contributions as spelt out in the EPF Act 1991 as well as the KWSP 1991 Rules and Regulations. Failure to comply is subject to penalties as listed below:

我们的服务包括:

- 准备就业手册

- 准备就业合同

- 准备公司人力资源政策和信函

- 计算薪资,如工资、加班费、佣金等

- 准备月度薪资报表