PERKESO

1. Understanding PERKESO

PERKESO, also known as the Social Security Organization, is a government agency established in 1971 under the Ministry of Human Resources.

The main function of PERKESO is to provide social security protection to employees and their dependents through the Employment Insurance Scheme.

2. Social Security Organization (SOSCO)

SOSCO stands for the Social Security Organization. SOSCO was established in 1971 under the Ministry of Human Resources to provide social security protections to all employees/workers in Malaysia. SOSCO is responsible for managing the Employment Injury Scheme (EIS) and the Invalidity Scheme.

The rate of contribution for SOCSO is determined by the Employees’ Social Security Act 1969 (Act 4) and is 1.25% of the insured monthly wages, to be paid by the employer. The contribution amount that applies to employees with salaries exceeding RM4,000 per month is stated in the Third Schedule, Act 4 and the Second Schedule, Act 800.

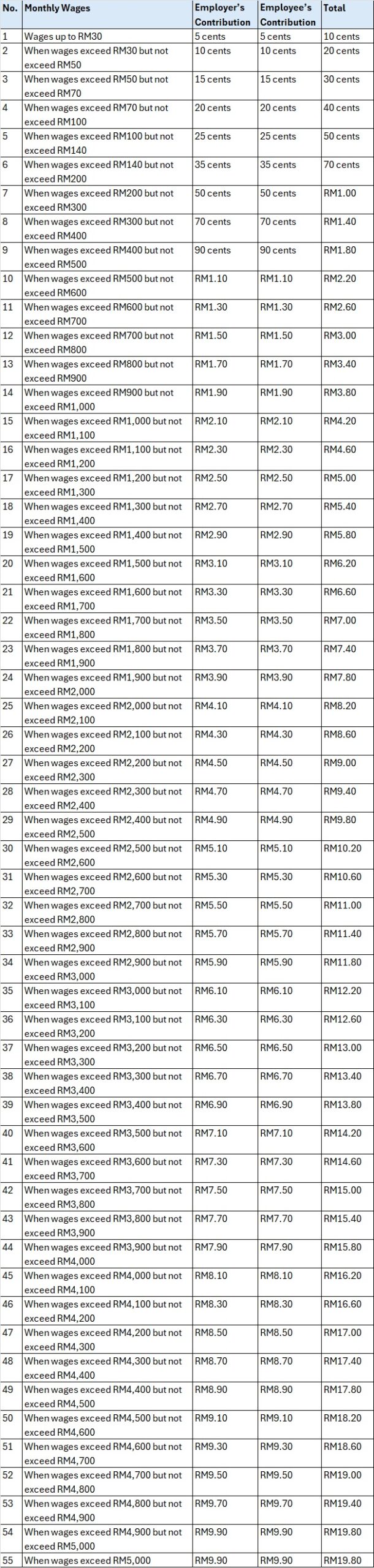

Here is the table of rates of contribution for the Employees’ Social Security Act 1969 (Act 4):

Please note that effective 1st September 2022, PERKESO will enforce a new wage ceiling for contributions from RM4,000 to RM5,000 per month. The contribution payment for the month of September 2022 and the subsequent months shall be made by the employer according to the new wage ceiling.

The following payments are liable for SOSCO contribution:

- Salary

- Overtime payment

- Allowance

- Commission

- Gratuity

- Wages for maternity/study/half-day leave

- Incentive

- Arrears of wages

- Service charges

- Payment for unutilized annual or medical leave

- Other payments under services contract or otherwise

The following payments are not liable for SOSCO contribution:

- Retirement benefits

- Severance pay or allowance

- Director’s fee

- Bonus

- Special expense (claims)

- Benefits in kinds

- Other remuneration

- Travelling allowance or the value of any travelling concession

- Payment in lieu of notice of termination of employment

3. Employment Insurance Scheme (EIS)

EIS stands for the Employment Insurance System. It is a government scheme that provides temporary financial assistance to retrenched workers for up to six months. The EIS is managed by SOSCO and functions similarly to the Employees Provident Fund (EPF).

Contributions to the EIS are made by both the employer and employee, and the contribution amount is based on the employee’s salary. The EIS contribution can be paid through the same channels as the SOSCO contribution.

Here is the table for EIS contribution:

The following payments are subject to EIS contribution:

- Basic salaries

- Overtime payments

- Commissions

- Payments in respect of leave

- Service charges

The following payments are exempted from EIS contribution:

- Any contribution payable by the employer towards any pension or provident fund

- Any travelling allowance

- Any gratuity payable on discharge or retirement of the employee

- Any sum paid to cover expenses incurred by the employee in the course of his duties

4. Registering with PERKESO

If you are a new employer or employee in Malaysia, you must register with PERKESO within 30 days of hiring a new employee. The registration process involves completing the Employer’s Registration Form (Form 1) and Employee’s Registration Form (Form 2) alongside other online documents in the ASSIST Portal. Here are the steps to follow:

- Download the forms: Download the following forms from the PERKESO website:

- Borang Permohonan Enrolment Penggunaan Portal Assist

- Borang 1 – Pendaftaran Majikan

- Borang 2 – Pendaftaran Pekerja

- Borang SIP 1 – Pendaftaran Majikan

- Borang SIP 2 – Pendaftaran Pekerja

- Complete the forms: Fill out the forms listed in Step 1 and scan them separately.

- Get your ID: Email the Borang Permohonan Enrolment Penggunaan Portal ASSIST to idportal@perkeso.gov.my to get your ID and temporary password.

- Upload the forms: Login to the ASSIST using the ID that has been emailed to you and upload the registration forms along with the supportive documents.

It is important to note that any changes regarding the name, address, type, or status of ownership of the company or employee can be made via the ASSIST Portal.

5. Resignation or Termination

According to the PERKESO, employers may notify the employee’s resignation to PERKESO through ASSIST portal. Employers can follow the steps below to update the status:

- Click at My Sites and choose REGISTRATION.

- Then click UPDATE, choose Update Add Employee Resigned Date

- Click on Action icon

- If all employee resign on the same date: a. Click All b. Update Employee Resign Date Or If there are other active employees: a. Click Specific b. Update Employee Resign Date c. In Please Select box, choose employee’s information according to IC Number / Employee’s name / Social Security No (SSN) d. Click on the Action button

- Click Save & Continue

- Upload the supporting documents

- Click Save & Continue

- Click Submit

- Proceed for Submission? Click Confirm

- Request Case Update Number is generated (Kindly keep the number for reference)

- Click OK

It is important to note that PERKESO covers employees who are employed for wages paid under a contract of service or apprenticeship with an employer, whether the contract is expressed or implied, or oral or in writing, or in connection to the work of an industry to which the Act applies.

6. Compliance requirements

The Employees’ Social Security Act, 1969, and the Employees’ Social Security (General) Regulations, 1971 apply to all industries with one or more employees.

Employers are divided into two categories: principal employers and immediate employers. Principal employers are responsible for all matters related to services and wage payments, while immediate employers hire employees to work under the supervision of the principal employer.

Employers must register with and contribute to the Social Security Organisation (SOCSO) at the rates specified under the Employees’ Social Security Act, 1969, which is administered by SOCSO.

Principal employers are also responsible for ensuring that all workers employed by immediate employers are registered with SOCSO and that contributions are paid accordingly. Employers must report any work-related accidents that happen to their workers within 48 hours of notification.

PERKESO issues compound notices for offenses reported or identified. The recipient has 14 days to make full payment to avoid further actions. Failure to pay within the given timeframe will result in prosecution without additional notice.

Failure to comply is subject to penalties as listed below:

我们的服务包括:

- 准备就业手册

- 准备就业合同

- 准备公司人力资源政策和信函

- 计算薪资,如工资、加班费、佣金等

- 准备月度薪资报表